factors_r <- c("SP500", "DTWEXAFEGS") # "SP500" does not contain dividends; note: "DTWEXM" discontinued as of Jan 2020

factors_d <- c("DGS10", "BAMLH0A0HYM2")Black-Scholes model

level_shock <- function(shock, S, tau, sigma) {

result <- S * (1 + shock * sigma * sqrt(tau))

return(result)

}- https://en.wikipedia.org/wiki/Greeks_(finance)

- https://www.wolframalpha.com/input/?i=option+pricing+formula

factor <- "SP500"

types <- c("call", "put")

S <- as.numeric(zoo::coredata(zoo::na.locf(levels_xts[nrow(levels_xts), factor]))) # Recycling array of length 1 in vector-array arithmetic is deprecated. Use c() or as.vector() instead.

K <- S

r <- 0 # use "USD3MTD156N"

q <- 0 # see https://stackoverflow.com/a/11286679

tau <- 1 # = 252 / 252

sigma <- as.numeric(zoo::coredata(sd_xts[nrow(sd_xts), factor])) # use "VIXCLS"

shocks <- seq(-3, 3, by = 0.5)greeks_dt <- data.table::CJ(type = types, shock = shocks)

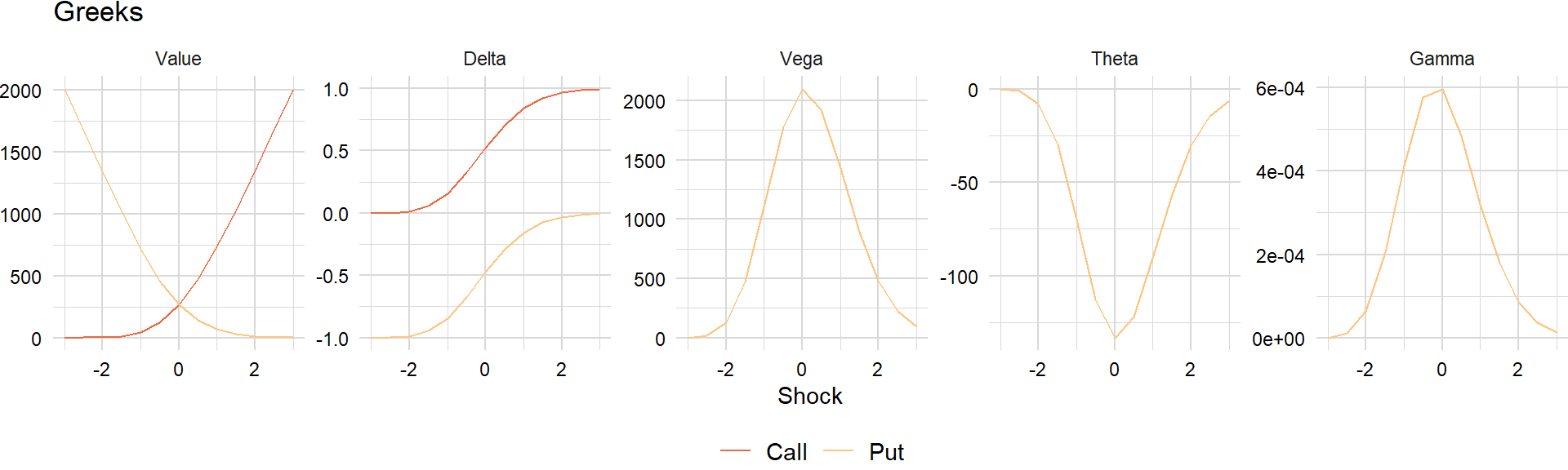

greeks_dt[ , spot := level_shock(shock, S, tau, sigma), by = c("type", "shock")]Value

For a given spot price \(S\), strike price \(K\), risk-free rate \(r\), annual dividend yield \(q\), time-to-maturity \(\tau = T - t\), and volatility \(\sigma\):

\[ \begin{aligned} V_{c}&=Se^{-q\tau}\Phi(d_{1})-e^{-r\tau}K\Phi(d_{2}) \\ V_{p}&=e^{-r\tau}K\Phi(-d_{2})-Se^{-q\tau}\Phi(-d_{1}) \end{aligned} \]

bs_value <- function(type, S, K, r, q, tau, sigma, d1, d2) {

r_df <- exp(-r * tau)

q_df <- exp(-q * tau)

call_value <- S * q_df * Phi(d1) - r_df * K * Phi(d2)

put_value <- r_df * K * Phi(-d2) - S * q_df * Phi(-d1)

result <- ifelse(type == "call", call_value, put_value)

return(result)

} where

\[ \begin{aligned} d_{1}&={\frac{\ln(S/K)+(r-q+\sigma^{2}/2)\tau}{\sigma{\sqrt{\tau}}}} \\ d_{2}&={\frac{\ln(S/K)+(r-q-\sigma^{2}/2)\tau}{\sigma{\sqrt{\tau}}}}=d_{1}-\sigma{\sqrt{\tau}} \\ \phi(x)&={\frac{e^{-{\frac {x^{2}}{2}}}}{\sqrt{2\pi}}} \\ \Phi(x)&={\frac{1}{\sqrt{2\pi}}}\int_{-\infty}^{x}e^{-{\frac{y^{2}}{2}}}dy=1-{\frac{1}{\sqrt{2\pi}}}\int_{x}^{\infty}e^{-{\frac{y^{2}}{2}}dy} \end{aligned} \]

bs_d1 <- function(S, K, r, q, tau, sigma) {

result <- (log(S / K) + (r - q + sigma ^ 2 / 2) * tau) / (sigma * sqrt(tau))

return(result)

}

bs_d2 <- function(S, K, r, q, tau, sigma) {

result <- (log(S / K) + (r - q - sigma ^ 2 / 2) * tau) / (sigma * sqrt(tau))

return(result)

}

phi <- function(x) {

result <- dnorm(x)

return(result)

}

Phi <- function(x) {

result <- pnorm(x)

return(result)

}greeks_dt[ , d1 := bs_d1(spot, K, r, q, tau, sigma), by = c("type", "shock")]

greeks_dt[ , d2 := bs_d2(spot, K, r, q, tau, sigma), by = c("type", "shock")]

greeks_dt[ , value := bs_value(type, spot, K, r, q, tau, sigma, d1, d2), by = c("type", "shock")]First-order

Delta

\[ \begin{aligned} \Delta_{c}&={\frac{\partial V_{c}}{\partial S}}=e^{-q\tau}\Phi(d_{1}) \\ \Delta_{p}&={\frac{\partial V_{p}}{\partial S}}=-e^{-q\tau}\Phi(-d_{1}) \end{aligned} \]

bs_delta <- function(type, S, K, r, q, tau, sigma, d1, d2) {

q_df <- exp(-q * tau)

call_value <- q_df * Phi(d1)

put_value <- -q_df * Phi(-d1)

result <- ifelse(type == "call", call_value, put_value)

return(result)

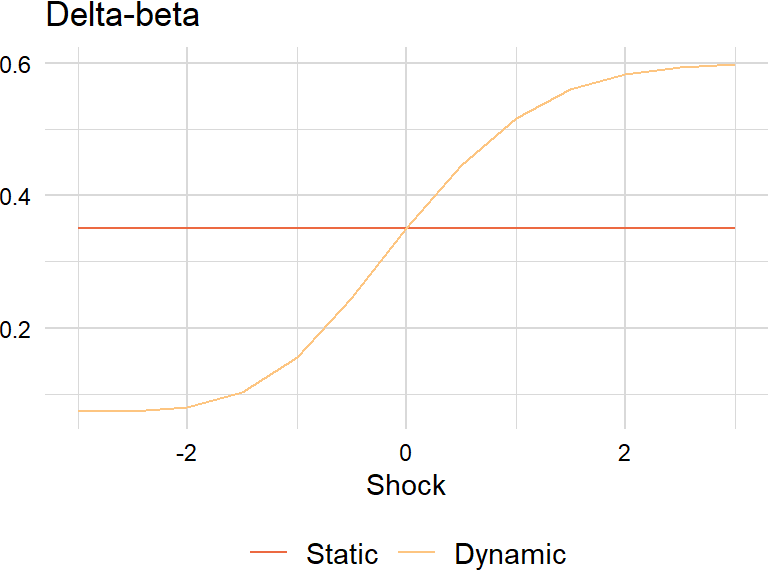

} greeks_dt[ , delta := bs_delta(type, spot, K, r, q, tau, sigma, d1, d2), by = c("type", "shock")]Delta-beta

Notional market value is the market value of a leveraged position:

\[ \begin{aligned} \text{Equity options }=&\,\#\text{ contracts}\times\text{multiple}\times\text{spot price}\\ \text{Delta-adjusted }=&\,\#\text{ contracts}\times\text{multiple}\times\text{spot price}\times\text{delta} \end{aligned} \]

bs_delta_diff <- function(type, S, K, r, q, tau, sigma, delta0) {

d1 <- bs_d1(S, K, r, q, tau, sigma)

d2 <- bs_d2(S, K, r, q, tau, sigma)

delta <- bs_delta(type, S, K, r, q, tau, sigma, d1, d2)

call_value <- delta - delta0

put_value <- delta0 - delta

result <- ifelse(type == "call", call_value, put_value)

return(result)

}beta <- 0.35

type <- "call"

n <- 1

multiple <- 100

total <- 1000000d1 <- bs_d1(S, K, r, q, tau, sigma)

d2 <- bs_d2(S, K, r, q, tau, sigma)

sec <- list(

"n" = n,

"multiple" = multiple,

"S" = S,

"delta" = bs_delta(type, S, K, r, q, tau, sigma, d1, d2),

"beta" = 1

)beta_dt <- data.table::CJ(type = type, shock = shocks)

beta_dt[ , spot := level_shock(shock, S, tau, sigma), by = c("type", "shock")]

beta_dt[ , static := beta]

beta_dt[ , diff := bs_delta_diff(type, spot, K, r, q, tau, sigma, sec[["delta"]])]

beta_dt[ , dynamic := beta + sec[["n"]] * sec[["multiple"]] * sec[["S"]] * sec[["beta"]] * diff / total, by = c("type", "shock")]

For completeness, duration equivalent is defined as:

\[ \begin{aligned} \text{10-year equivalent }=\,&\frac{\text{security duration}}{\text{10-year OTR duration}} \end{aligned} \]

Vega

\[ \begin{aligned} \nu_{c,p}&={\frac{\partial V_{c,p}}{\partial\sigma}}=Se^{-q\tau}\phi(d_{1}){\sqrt{\tau}}=Ke^{-r\tau}\phi(d_{2}){\sqrt{\tau}} \end{aligned} \]

bs_vega <- function(type, S, K, r, q, tau, sigma, d1, d2) {

q_df <- exp(-q * tau)

result <- S * q_df * phi(d1) * sqrt(tau)

return(result)

}greeks_dt[ , vega := bs_vega(type, spot, K, r, q, tau, sigma, d1, d2), by = c("type", "shock")]Theta

\[ \begin{aligned} \Theta_{c}&=-{\frac{\partial V_{c}}{\partial \tau}}=-e^{-q\tau}{\frac{S\phi(d_{1})\sigma}{2{\sqrt{\tau}}}}-rKe^{-r\tau}\Phi(d_{2})+qSe^{-q\tau}\Phi(d_{1}) \\ \Theta_{p}&=-{\frac{\partial V_{p}}{\partial \tau}}=-e^{-q\tau}{\frac{S\phi(d_{1})\sigma}{2{\sqrt{\tau}}}}+rKe^{-r\tau}\Phi(-d_{2})-qSe^{-q\tau}\Phi(-d_{1}) \end{aligned} \]

bs_theta <- function(type, S, K, r, q, tau, sigma, d1, d2) {

r_df <- exp(r * tau)

q_df <- exp(q * tau)

call_value <- -q_df * S * phi(d1) * sigma / (2 * sqrt(tau)) -

r * K * r_df * Phi(d2) + q * S * q_df * Phi(d1)

put_value <- -q_df * S * phi(d1) * sigma / (2 * sqrt(tau)) +

r * K * r_df * Phi(-d2) - q * S * q_df * Phi(-d1)

result <- ifelse(type == "call", call_value, put_value)

return(result)

}greeks_dt[ , theta := bs_theta(type, spot, K, r, q, tau, sigma, d1, d2), by = c("type", "shock")]Second-order

Gamma

\[ \begin{aligned} \Gamma_{c,p}&={\frac{\partial\Delta_{c,p}}{\partial S}}={\frac{\partial^{2}V_{c,p}}{\partial S^{2}}}=e^{-q\tau}{\frac{\phi(d_{1})}{S\sigma{\sqrt{\tau}}}}=Ke^{-r\tau}{\frac{\phi(d_{2})}{S^{2}\sigma{\sqrt{\tau}}}} \end{aligned} \]

bs_gamma <- function(type, S, K, r, q, tau, sigma, d1, d2) {

q_df <- exp(-q * tau)

result <- q_df * phi(d1) / (S * sigma * sqrt(tau))

return(result)

}greeks_dt[ , gamma := bs_gamma(type, spot, K, r, q, tau, sigma, d1, d2), by = c("type", "shock")]

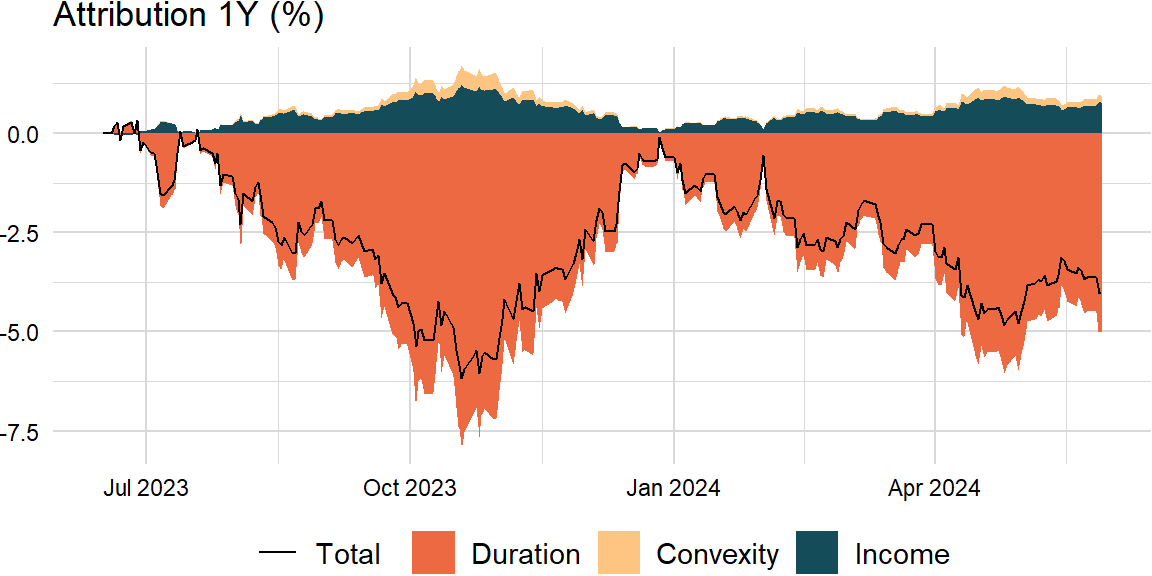

Taylor series

First-order

Price-yield formula

For a function of one variable, \(f(x)\), the Taylor series formula is:

\[ \begin{aligned} f(x+\Delta x)&=f(x)+{\frac{f'(x)}{1!}}\Delta x+{\frac{f''(x)}{2!}}(\Delta x)^{2}+{\frac{f^{(3)}(x)}{3!}}(\Delta x)^{3}+\cdots+{\frac{f^{(n)}(x)}{n!}}(\Delta x)^{n}+\cdots\\ f(x+\Delta x)-f(x)&={\frac{f'(x)}{1!}}\Delta x+{\frac{f''(x)}{2!}}(\Delta x)^{2}+{\frac{f^{(3)}(x)}{3!}}(\Delta x)^{3}+\cdots+{\frac{f^{(n)}(x)}{n!}}(\Delta x)^{n}+\cdots \end{aligned} \]

Using the price-yield formula, the estimated percentage change in price for a change in yield is:

\[ \begin{aligned} P(y+\Delta y)-P(y)&\approx{\frac{P'(y)}{1!}}\Delta y+{\frac{P''(y)}{2!}}(\Delta y)^{2}\\ &\approx -D\Delta y +{\frac{C}{2!}}(\Delta y)^{2} \end{aligned} \]

pnl_bond <- function(duration, convexity, dy) {

duration_pnl <- -duration * dy

convexity_pnl <- (convexity / 2) * dy ^ 2

income_pnl <- dy

result <- list(

"total" = duration_pnl + convexity_pnl + income_pnl,

"duration" = duration_pnl,

"convexity" = convexity_pnl,

"income" = income_pnl

)

return(result)

} - https://engineering.nyu.edu/sites/default/files/2021-07/CarWuRF2021.pdf

- https://onlinelibrary.wiley.com/doi/pdf/10.1002/9781118267967.app1

- https://www.investopedia.com/terms/c/convexity-adjustment.asp

factor <- "DGS10"

duration <- 6.5

convexity <- 0.65

y <- zoo::coredata(tail(zoo::na.locf(levels_xts[ , factor]), width)[1])bonds_dt <- data.table::data.table(index = zoo::index(tail(levels_xts, width)),

duration = duration, convexity = convexity,

dy = zoo::na.locf(tail(levels_xts[ , factor], width)))

data.table::setnames(bonds_dt, c("index", "duration", "convexity", "dy"))

bonds_dt[ , dy := (dy - y) / 100, by = index]attrib_dt <- bonds_dt[ , as.list(unlist(pnl_bond(duration, convexity, dy))), by = index]

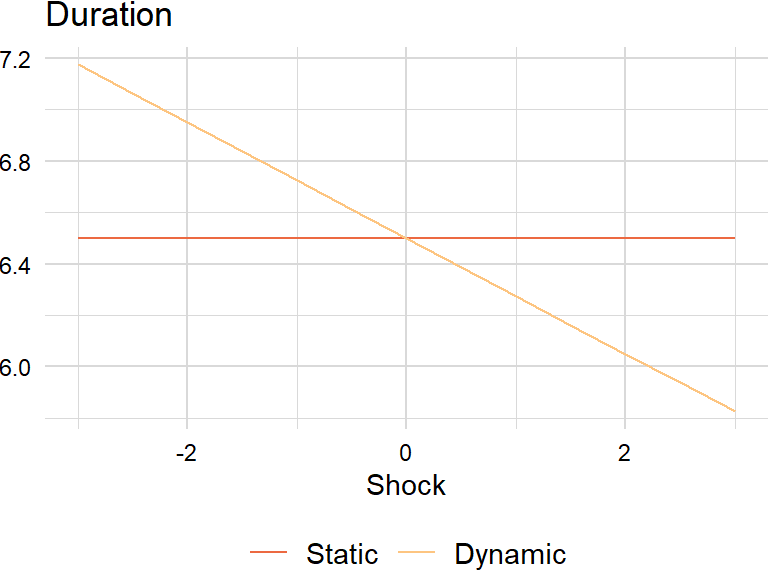

Duration-yield formula

The derivative of duration with respect to interest rates gives:

\[ \begin{aligned} \text{Drift}&=\frac{\partial D}{\partial y}=\frac{\partial}{\partial y}\left(-\frac{1}{P}\frac{\partial D}{\partial y}\right)\\ &=-\frac{1}{P}\frac{\partial^{2}P}{\partial y^{2}}+\frac{1}{P^{2}}\frac{\partial P}{\partial y}\frac{\partial P}{\partial y}\\ &=-C+D^{2} \end{aligned} \]

Because of market conventions, use the following formula: \(\text{Drift}=\frac{1}{100}\left(-C\times 100+D^{2}\right)=-C+\frac{D^{2}}{100}\). For example, if convexity and yield are percent then \(\text{Drift}=\left(-0.65+\frac{6.5^{2}}{100}\right)\partial y\times100\) or basis points then \(\text{Drift}=\left(-65+6.5^{2}\right)\partial y\).

yield_shock <- function(shock, tau, sigma) {

result <- shock * sigma * sqrt(tau)

return(result)

}duration_drift <- function(duration, convexity, dy) {

drift <- -convexity + duration ^ 2 / 100

change <- drift * dy * 100

result <- list(

"drift" = drift,

"change" = change

)

return(result)

}# "Risk Management: Approaches for Fixed Income Markets" (page 45)

factor <- "DGS10"

sigma <- zoo::coredata(sd_xts[nrow(sd_xts), factor])duration_dt <- data.table::CJ(shock = shocks)

duration_dt[ , spot := yield_shock(shock, tau, sigma), by = "shock"]

duration_dt[ , static := duration]

duration_dt[ , dynamic := duration + duration_drift(duration, convexity, spot)[["change"]], by = "shock"]

Second-order

Black’s formula

A similar formula holds for functions of several variables \(f(x_{1},\ldots,x_{n})\). This is usually written as:

\[ \begin{aligned} f(x_{1}+\Delta x_{1},\ldots,x_{n}+\Delta x_{n})&=f(x_{1},\ldots, x_{n})+ \sum _{j=1}^{n}{\frac{\partial f(x_{1},\ldots,x_{n})}{\partial x_{j}}}(\Delta x_{j})\\ &+{\frac {1}{2!}}\sum_{j=1}^{n}\sum_{k=1}^{n}{\frac{\partial^{2}f(x_{1},\ldots,x_{d})}{\partial x_{j}\partial x_{k}}}(\Delta x_{j})(\Delta x_{k})+\cdots \end{aligned} \]

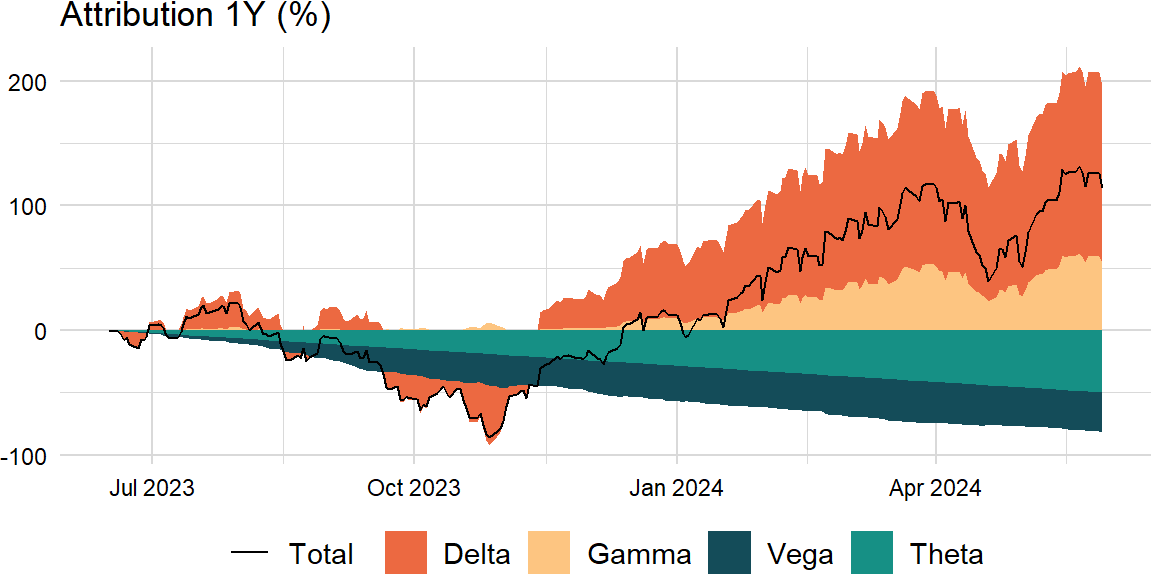

Using Black’s formula, the estimated change of an option price is:

\[ \begin{aligned} V(S+\Delta S,\sigma+\Delta\sigma,t+\Delta t)-V(S,\sigma,t)&\approx{\frac{\partial V}{\partial S}}\Delta S+{\frac{1}{2!}}{\frac{\partial^{2}V}{\partial S^{2}}}(\Delta S)^{2}+{\frac{\partial V}{\partial \sigma}}\Delta\sigma+{\frac{\partial V}{\partial t}}\Delta t\\ &\approx \Delta_{c,p}\Delta S+{\frac{1}{2!}}\Gamma_{c,p}(\Delta S)^{2}+\nu_{c,p}\Delta\sigma+\Theta_{c,p}\Delta t \end{aligned} \]

pnl_option <- function(type, S, K, r, q, tau, sigma, dS, dt, dsigma) {

d1 <- bs_d1(S, K, r, q, tau, sigma)

d2 <- bs_d2(S, K, r, q, tau, sigma)

value <- bs_value(type, S, K, r, q, tau, sigma, d1, d2)

delta <- bs_delta(type, S, K, r, q, tau, sigma, d1, d2)

vega <- bs_vega(type, S, K, r, q, tau, sigma, d1, d2)

theta <- bs_theta(type, S, K, r, q, tau, sigma, d1, d2)

gamma <- bs_gamma(type, S, K, r, q, tau, sigma, d1, d2)

delta_pnl <- delta * dS / value

gamma_pnl <- gamma / 2 * dS ^ 2 / value

vega_pnl <- vega * dsigma / value

theta_pnl <- theta * dt / value

result <- list(

"total" = delta_pnl + gamma_pnl + vega_pnl + theta_pnl,

"delta" = delta_pnl,

"gamma" = gamma_pnl,

"vega" = vega_pnl,

"theta" = theta_pnl

)

return(result)

}factor <- "SP500"

type <- "call"

S <- zoo::coredata(tail(zoo::na.locf(levels_xts[ , factor]), width)[1])

K <- S # * (1 + 0.05)

tau <- 1 # = 252 / 252

sigma <- zoo::coredata(tail(sd_xts[ , factor], width)[1])options_dt <- data.table::data.table(index = zoo::index(tail(levels_xts, width)),

spot = zoo::na.locf(tail(levels_xts[ , factor], width)),

sigma = tail(sd_xts[ , factor], width))

data.table::setnames(options_dt, c("index", "spot", "sigma"))

options_dt[ , dS := spot - S, by = index]

options_dt[ , dt_diff := as.numeric(index - index[1])]

options_dt[ , dt := dt_diff / tail(dt_diff, 1)]

options_dt[ , dsigma := sigma - ..sigma, by = index]attrib_dt <- options_dt[ , as.list(unlist(pnl_option(type, S, K, r, q, tau, ..sigma,

dS, dt, dsigma))), by = index]

Ito’s lemma

For a given diffiusion \(X(t, w)\) driven by:

\[ \begin{aligned} dX_{t}&=\mu_{t}dt+\sigma_{t}dB_{t} \end{aligned} \]

Then proceed with the Taylor series for a function of two variables \(f(t,x)\):

\[ \begin{aligned} df&={\frac{\partial f}{\partial t}}dt+{\frac{\partial f}{\partial x}}dx+{\frac{1}{2}}{\frac{\partial^{2}f}{\partial x^{2}}}dx^{2}\\ &={\frac{\partial f}{\partial t}}dt+{\frac{\partial f}{\partial x}}(\mu_{t}dt+\sigma_{t}dB_{t})+{\frac{1}{2}}{\frac{\partial^{2}f}{\partial x^{2}}}\left(\mu_{t}^{2}dt^{2}+2\mu_{t}\sigma _{t}dtdB_{t}+\sigma_{t}^{2}dB_{t}^{2}\right)\\ &=\left({\frac{\partial f}{\partial t}}+\mu_{t}{\frac{\partial f}{\partial x}}+{\frac{\sigma _{t}^{2}}{2}}{\frac{\partial ^{2}f}{\partial x^{2}}}\right)dt+\sigma_{t}{\frac{\partial f}{\partial x}}dB_{t} \end{aligned} \]

Note: set the \(dt^{2}\) and \(dtdB_{t}\) terms to zero and substitute \(dt\) for \(dB^{2}\).

Geometric Brownian motion

The most common application of Ito’s lemma in finance is to start with the percent change of an asset:

\[ \begin{aligned} \frac{dS}{S}&=\mu_{t}dt+\sigma_{t}dB_{t} \end{aligned} \]

Then apply Ito’s lemma with \(f(S)=log(S)\):

\[ \begin{aligned} d\log(S)&=f^{\prime}(S)dS+{\frac{1}{2}}f^{\prime\prime}(S)S^{2}\sigma^{2}dt\\ &={\frac {1}{S}}\left(\sigma SdB+\mu Sdt\right)-{\frac{1}{2}}\sigma^{2}dt\\ &=\sigma dB+\left(\mu-{\tfrac{\sigma^{2}}{2}}\right)dt \end{aligned} \]

It follows that:

\[ \begin{aligned} \log(S_{t})-\log(S_{0})=\sigma dB+\left(\mu-{\tfrac{\sigma^{2}}{2}}\right)dt \end{aligned} \]

Exponentiating gives the expression for \(S\):

\[ \begin{aligned} S_{t}=S_{0}\exp\left(\sigma B_{t}+\left(\mu-{\tfrac{\sigma^{2}}{2}}\right)t\right) \end{aligned} \]

This provides a recursive procedure for simulating values of \(S\) at \(t_{0}<t_{1}<\cdots<t_{n}\):

\[ \begin{aligned} S(t_{i+1})&=S(t_{i})\exp\left(\sigma\sqrt{t_{i+1}-t_{i}}Z_{i+1}+\left[\mu-{\tfrac{\sigma^{2}}{2}}\right]\left(t_{i+1}-t_{i}\right)\right) \end{aligned} \]

where \(Z_{1},Z_{2},\ldots,Z_{n}\) are independent standard normals.

sim_gbm <- function(n_sim, S, mu, sigma, dt) {

result <- S * exp(cumsum(sigma * sqrt(dt) * rnorm(n_sim)) +

(mu - 0.5 * sigma ^ 2) * dt)

return(result)

}This leads to an algorithm for simulating a multidimensional geometric Brownian motion:

\[ \begin{aligned} S_{k}(t_{i+1})&=S_{k}(t_{i})\exp\left(\sqrt{t_{i+1}-t_{i}}\sum_{j=1}^{d}{A_{kj}Z_{i+1,j}}+\left[\mu_{k}-{\tfrac{\sigma_{k}^{2}}{2}}\right]\left(t_{i+1}-t_{i}\right)\right) \end{aligned} \]

where \(A\) is the Cholesky factor of \(\Sigma\), i.e. \(A\) is any matrix for which \(AA^\mathrm{T}=\Sigma\).

sim_multi_gbm <- function(n_sim, S, mu, sigma, dt) {

n_cols <- ncol(sigma)

Z <- matrix(rnorm(n_sim * n_cols), nrow = n_sim, ncol = n_cols)

X <- sweep(sqrt(dt) * (Z %*% chol(sigma)), 2, (mu - 0.5 * diag(sigma)) * dt, "+")

result <- sweep(apply(X, 2, function(x) exp(cumsum(x))), 2, S, "*")

return(result)

}- https://arxiv.org/pdf/0812.4210.pdf

- https://quant.stackexchange.com/questions/15219/calibration-of-a-gbm-what-should-dt-be

- https://stackoverflow.com/questions/36463227/geometrical-brownian-motion-simulation-in-r

- https://quant.stackexchange.com/questions/25219/simulate-correlated-geometric-brownian-motion-in-the-r-programming-language

- https://quant.stackexchange.com/questions/35194/estimating-the-historical-drift-and-volatility/

S <- rep(1, length(factors))

sigma <- cov(returns_xts, use = "complete.obs") * scale[["periods"]]

mu <- colMeans(na.omit(returns_xts)) * scale[["periods"]]

mu <- mu + diag(sigma) / 2 # drift

dt <- 1 / scale[["periods"]]mu_ls <- list()

sigma_ls <- list()for (i in 1:1e4) {

# assumes stock prices

levels_sim <- sim_multi_gbm(width + 1, S, mu, sigma, dt)

returns_sim <- diff(log(levels_sim))

mu_sim <- colMeans(returns_sim) * scale[["periods"]]

sigma_sim <- apply(returns_sim, 2, sd) * sqrt(scale[["periods"]])

mu_ls <- append(mu_ls, list(mu_sim))

sigma_ls <- append(sigma_ls, list(sigma_sim))

}data.frame(

"empirical" = colMeans(na.omit(returns_xts)) * scale[["periods"]],

"theoretical" = colMeans(do.call(rbind, mu_ls)

)) empirical theoretical

SP500 0.1182866969 0.1192013486

DTWEXAFEGS -0.0054335166 -0.0049268087

DGS10 -0.0005403087 -0.0005663181

BAMLH0A0HYM2 0.0040523156 0.0039961740data.frame(

"empirical" = sqrt(diag(sigma)),

"theoretical" = colMeans(do.call(rbind, sigma_ls))

) empirical theoretical

SP500 0.183914917 0.183748752

DTWEXAFEGS 0.061168097 0.061124763

DGS10 0.008470421 0.008464328

BAMLH0A0HYM2 0.016957011 0.016941305Vasicek model

# assumes interest rates follow mean-reverting process with stochastic volatilityNewton’s method

Implied volatility

Newton’s method (main idea is also from a Taylor series) is a method for finding approximations to the roots of a function \(f(x)\):

\[ \begin{aligned} x_{n+1}=x_{n}-{\frac{f(x_{n})}{f'(x_{n})}} \end{aligned} \]

To solve \(V(\sigma_{n})-V=0\) for \(\sigma_{n}\), use Newton’s method and repeat until \(\left|\sigma_{n+1}-\sigma_{n}\right|<\varepsilon\):

\[ \begin{aligned} \sigma_{n+1}=\sigma_{n}-{\frac{V(\sigma_{n})-V}{V'(\sigma_{n})}} \end{aligned} \]

implied_vol_newton <- function(params, type, S, K, r, q, tau) {

target0 <- 0

sigma <- params[["sigma"]]

sigma0 <- sigma

while (abs(target0 - params[["target"]]) > params[["tol"]]) {

d1 <- bs_d1(S, K, r, q, tau, sigma0)

d2 <- bs_d2(S, K, r, q, tau, sigma0)

target0 <- bs_value(type, S, K, r, q, tau, sigma0, d1, d2)

d_target0 <- bs_vega(type, S, K, r, q, tau, sigma0, d1, d2)

sigma <- sigma0 - (target0 - params[["target"]]) / d_target0

sigma0 <- sigma

}

return(sigma)

}- http://www.aspenres.com/documents/help/userguide/help/bopthelp/bopt2Implied_Volatility_Formula.html

- https://books.google.com/books?id=VLi61POD61IC&pg=PA104

S <- zoo::coredata(zoo::na.locf(levels_xts)[nrow(levels_xts), factor])

K <- S # * (1 + 0.05)

sigma <- zoo::coredata(sd_xts[nrow(sd_xts), factor]) # overrides matrix

start1 <- 0.2d1 <- bs_d1(S, K, r, q, tau, sigma)

d2 <- bs_d2(S, K, r, q, tau, sigma)

target1 <- bs_value(type, S, K, r, q, tau, sigma, d1, d2)

params1 <- list(

"target" = target1,

"sigma" = start1,

"tol" = 1e-4 # .Machine$double.eps

)implied_vol_newton(params1, type, S, K, r, q, tau) SP500

[1,] 0.1874257Yield-to-maturity

yld_newton <- function(params, cash_flows) {

target0 <- 0

yld <- params[["cpn"]]

yld0 <- yld

while (abs(target0 - params[["target"]]) > params[["tol"]]) {

target0 <- 0

d_target0 <- 0

dd_target0 <- 0

for (i in 1:length(cash_flows)) {

t <- i

# present value of cash flows

target0 <- target0 + cash_flows[i] / (1 + yld0) ^ t

# first derivative of present value of cash flows

d_target0 <- d_target0 - t * cash_flows[i] / (1 + yld0) ^ (t + 1) # use t for Macaulay duration

# second derivative of present value of cash flows

dd_target0 <- dd_target0 - t * (t + 1) * cash_flows[i] / (1 + yld0) ^ (t + 2)

}

yld <- yld0 - (target0 - params[["target"]]) / d_target0

yld0 <- yld

}

result <- list(

"price" = target0,

"yield" = yld * params[["freq"]],

"duration" = -d_target0 / params[["target"]] / params[["freq"]],

"convexity" = -dd_target0 / params[["target"]] / params[["freq"]] ^ 2

)

return(result)

}- https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

- https://quant.stackexchange.com/a/61025

- https://pages.stern.nyu.edu/~igiddy/spreadsheets/duration-convexity.xls

target2 <- 0.9928 * 1000 # present value

start2 <- 0.0438 # coupon

cash_flows <- rep(start2 * 1000 / 2, 10 * 2)

cash_flows[10 * 2] <- cash_flows[10 * 2] + 1000params2 <- list(

"target" = target2,

"cpn" = start2,

"freq" = 2,

"tol" = 1e-4 # .Machine$double.eps

)t(yld_newton(params2, cash_flows)) price yield duration convexity

[1,] 992.8 0.04470076 8.016596 76.6811 Optimization

Implied volatility

If the derivative is unknown, try optimization:

implied_vol_obj <- function(param, type, S, K, r, q, tau, target) {

d1 <- bs_d1(S, K, r, q, tau, param)

d2 <- bs_d2(S, K, r, q, tau, param)

target0 <- bs_value(type, S, K, r, q, tau, param, d1, d2)

result <- abs(target0 - target)

return(result)

}

implied_vol_optim <- function(param, type, S, K, r, q, tau, target) {

result <- optim(param, implied_vol_obj, type = type, S = S, K = K, r = r, q = q,

tau = tau, target = target, method = "Brent", lower = 0, upper = 1)

return(result$par)

}implied_vol_optim(start1, type, S, K, r, q, tau, target1)[1] 0.1874257Yield-to-maturity

yld_obj <- function(param, cash_flows, target) {

target0 <- 0

for (i in 1:length(cash_flows)) {

target0 <- target0 + cash_flows[i] / (1 + param) ^ i

}

result <- abs(target0 - target)

return(result)

}

yld_optim <- function(params, cash_flows, target) {

result <- optim(params[["cpn"]], yld_obj, target = target, cash_flows = cash_flows,

method = "Brent", lower = 0, upper = 1)

return(result$par * params[["freq"]])

}yld_optim(params2, cash_flows, target2)[1] 0.04470077