factors_r <- c("SP500", "DTWEXAFEGS") # "SP500" does not contain dividends; note: "DTWEXM" discontinued as of Jan 2020

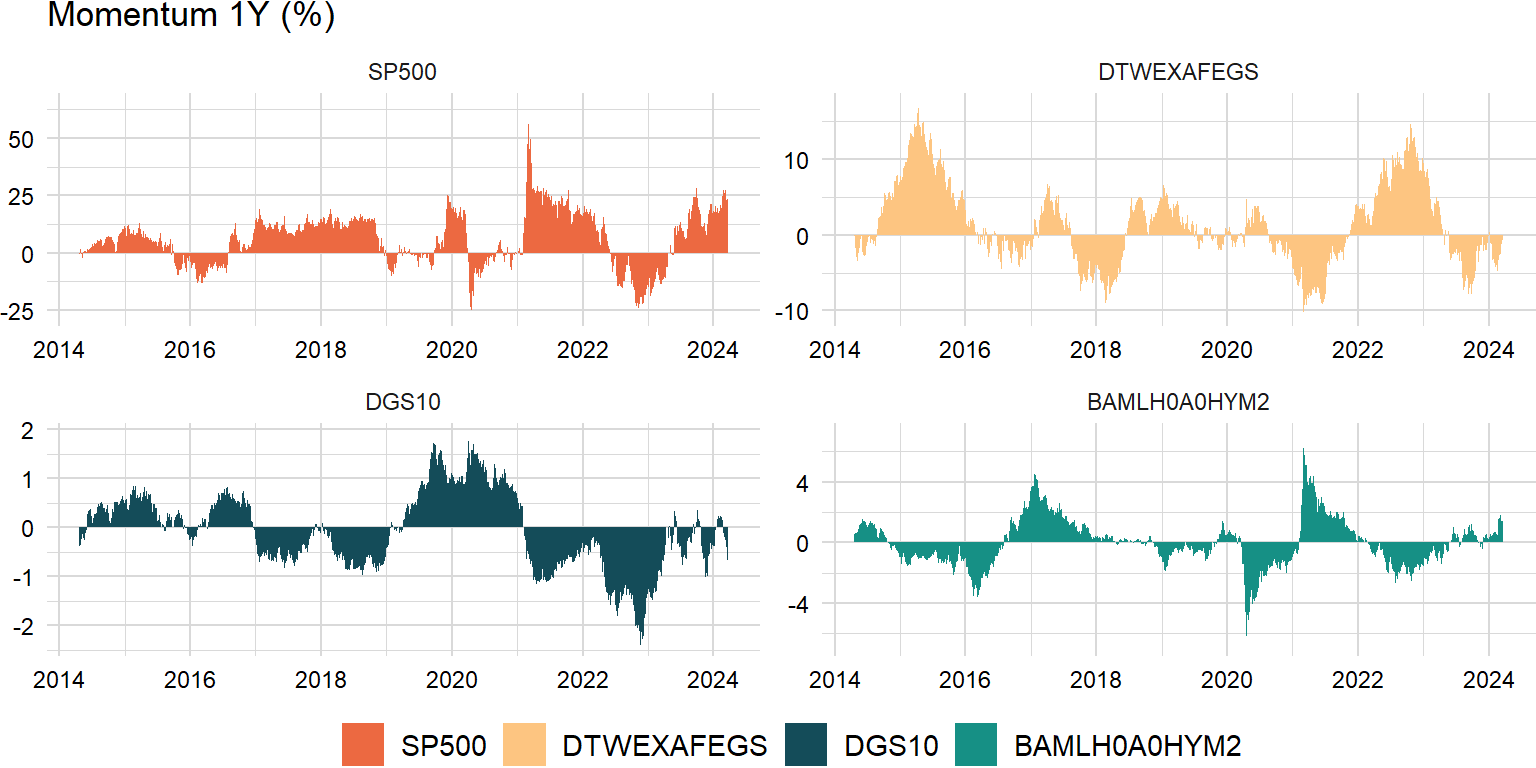

factors_d <- c("DGS10", "BAMLH0A0HYM2")Price momentum

One month reversal and 2-12 month momentum are two ends of the spectrum. The general trend indicates that positive acceleration leads to reversals or negative acceleration leads to rebounds. An unsustainable acceleration leading to reversal can reconcile the one-month reversal and 2-12 month momentum. The key is that it implies that acceleration is not sustainable.

order <- 20# "Momentum, Acceleration, and Reversal"

momentum_xts <- na.omit(lag(roll::roll_prod(1 + returns_xts, width - order, min_obs = 1) - 1, order))

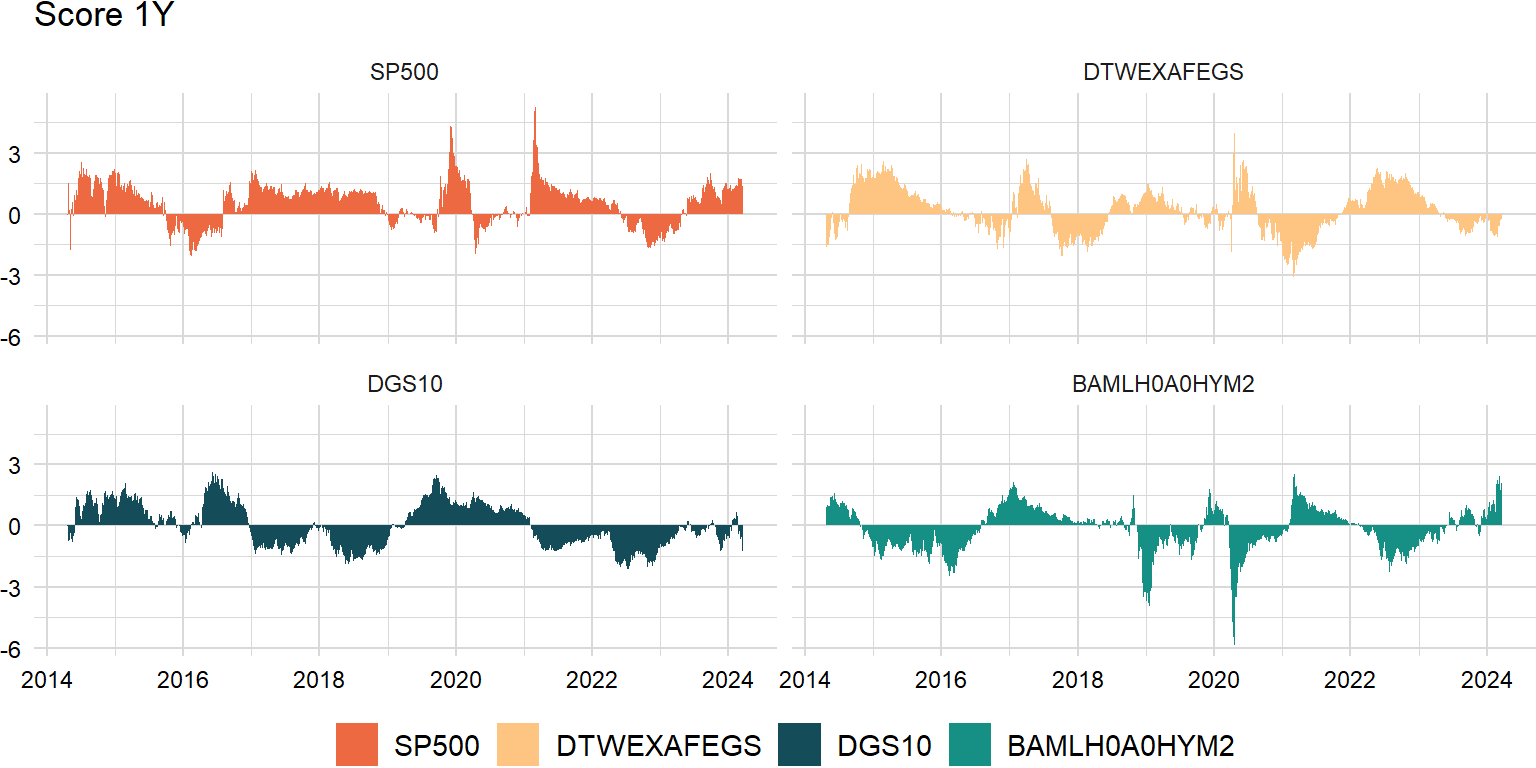

Time-series score

Suppose we are looking at \(n\) independent and identically distributed random variables, \(X_{1},X_{2},\ldots,X_{n}\). Since they are iid, each random variable \(X_{i}\) has to have the same mean, which we will call \(\mu\), and variance, which we will call \(\sigma^{2}\):

\[ \begin{aligned} \mathrm{E}\left(X_{i}\right)&=\mu\\ \mathrm{Var}\left(X_{i}\right)&=\sigma^{2} \end{aligned} \]

Let’s suppose we want to look at the average value of our \(n\) random variables:

\[ \begin{aligned} \bar{X}=\frac{X_{1}+X_{2}+\cdots+X_{n}}{n}=\left(\frac{1}{n}\right)\left(X_{1}+X_{2}+\cdots+X_{n}\right) \end{aligned} \]

We want to find the expected value and variance of the average, \(\mathrm{E}\left(\bar{X}\right)\) and \(\mathrm{Var}\left(\bar{X}\right)\).

Expected value

\[ \begin{aligned} \mathrm{E}\left(\bar{X}\right)&=\mathrm{E}\left[\left(\frac{1}{n}\right)\left(X_{1}+X_{2}+\cdots+X_{n}\right)\right]\\ &=\left(\frac{1}{n}\right)\mathrm{E}\left(X_{1}+X_{2}+\cdots+X_{n}\right)\\ &=\left(\frac{1}{n}\right)\left(n\mu\right)\\ &=\mu \end{aligned} \]

Variance

\[ \begin{aligned} \mathrm{Var}\left(\bar{X}\right)&=\mathrm{Var}\left[\left(\frac{1}{n}\right)\left(X_{1}+X_{2}+\cdots+X_{n}\right)\right]\\ &=\left(\frac{1}{n}\right)^{2}\mathrm{Var}\left(X_{1}+X_{2}+\cdots+X_{n}\right)\\ &=\left(\frac{1}{n}\right)^{2}\left(n\sigma^{2}\right)\\ &=\frac{\sigma^{2}}{n} \end{aligned} \]

# volatility scale only

score_xts <- na.omit(momentum_xts / roll::roll_sd(momentum_xts, width, center = FALSE, min_obs = 1))# overall_xts <- xts::xts(rowMeans(score_xts), zoo::index(score_xts))

# overall_xts <- overall_xts / roll::roll_sd(overall_xts, width, center = FALSE, min_obs = 1)

# colnames(overall_xts) <- "Overall"# score_xts <- na.omit(merge(overall_xts, score_xts))

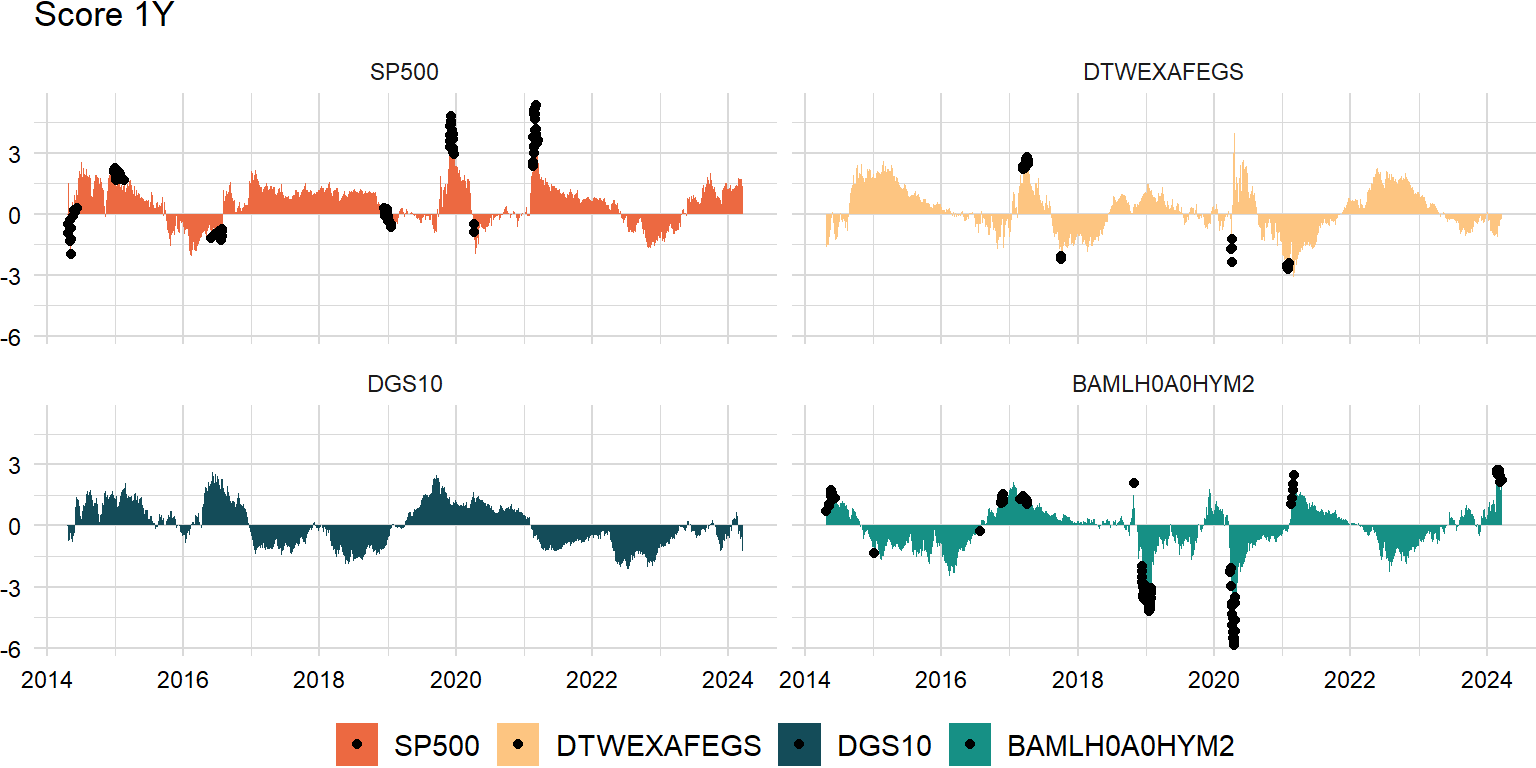

Outlier detection

Interquartile range

Outliers are defined as the regression residuals that fall below \(Q_{1}−1.5\times IQR\) or above \(Q_{3}+1.5\times IQR\):

- https://stats.stackexchange.com/a/1153

- https://stats.stackexchange.com/a/108951

- https://robjhyndman.com/hyndsight/tsoutliers/

outliers <- function(z) {

n_cols <- ncol(z)

result_ls <- list()

for (j in 1:n_cols) {

y <- z[ , j]

if (n_cols == 1) {

x <- 1:length(y)

} else {

x <- cbind(1:length(y), z[ , -j])

}

coef <- coef(lm(y ~ x))

predict <- coef[1] + x %*% as.matrix(coef[-1])

resid <- y - predict

lower <- quantile(resid, prob = 0.25)

upper <- quantile(resid, prob = 0.75)

iqr <- upper - lower

total <- y[(resid < lower - 1.5 * iqr) | (resid > upper + 1.5 * iqr)]

result_ls <- append(result_ls, list(total))

}

result <- do.call(merge, result_ls)

return(result)

}outliers_xts <- outliers(score_xts)

Contour ellipsoid

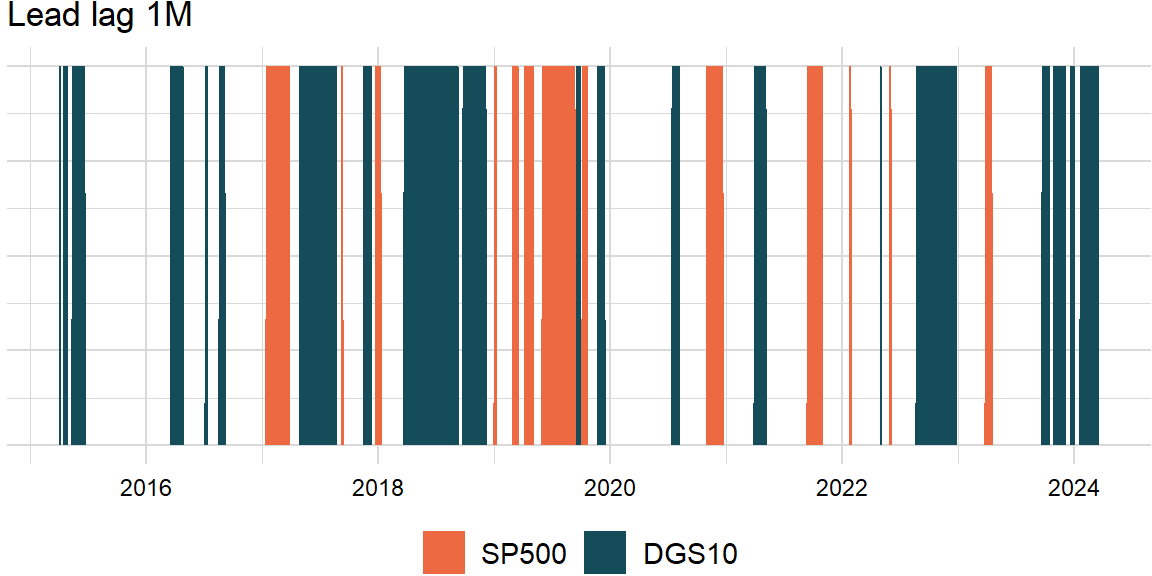

Granger causality

\[ \begin{aligned} \left(R\hat{\beta}-r\right)^\mathrm{T}\left(R\hat{V}R^\mathrm{T}\right)^{-1}\left(R\hat{\beta}-r\right)\xrightarrow\quad\chi_{Q}^{2} \end{aligned} \]

- https://github.com/cran/lmtest/blob/master/R/waldtest.R

- https://en.wikipedia.org/wiki/Wald_test#Test(s)_on_multiple_parameters

- https://math.stackexchange.com/a/1591946

granger_test <- function(x, y, order) {

# compute lagged observations

lag_x <- lag(x, order)

lag_y <- lag(y, order)

# collect series

data <- merge(x, y, lag_x, lag_y)

colnames(data) <- c("x", "y", "lag_x", "lag_y")

# fit full model

fit <- lm(y ~ lag_y + lag_x, data = data)

R <- matrix(c(0, 0, 1), nrow = 1)

coef <- fit$coefficients

r <- 0 # technically a matrix (see Stack Exchange)

wald <- t(R %*% coef - r) %*% solve(R %*% vcov(fit) %*% t(R)) %*% (R %*% coef - r)

result <- 1 - pchisq(wald, 1)

return(result)

}roll_lead_lag <- function(x, y, width, order, p_value) {

n_rows <- nrow(x)

x_name <- names(x)

y_name <- names(y)

x_y_ls <- list()

y_x_ls <- list()

for (i in width:n_rows) {

idx <- max(i - width + 1, 1):i

x_y <- granger_test(x[idx], y[idx], order)

y_x <- granger_test(y[idx], x[idx], order)

x_y_status <- (x_y < p_value) && (y_x > p_value)

y_x_status <- (x_y > p_value) && (y_x < p_value)

x_y_ls <- append(x_y_ls, list(x_y_status))

y_x_ls <- append(y_x_ls, list(y_x_status))

}

result <- data.frame(do.call(c, x_y_ls), do.call(c, y_x_ls))

result <- xts::xts(result, zoo::index(x)[width:n_rows])

colnames(result) <- c(x_name, y_name)

return(result)

}p_value <- 0.05score_x_xts <- score_xts[ , "SP500"]

score_y_xts <- score_xts[ , "DGS10"]lead_lag_xts <- roll_lead_lag(score_x_xts, score_y_xts, width, order, p_value)